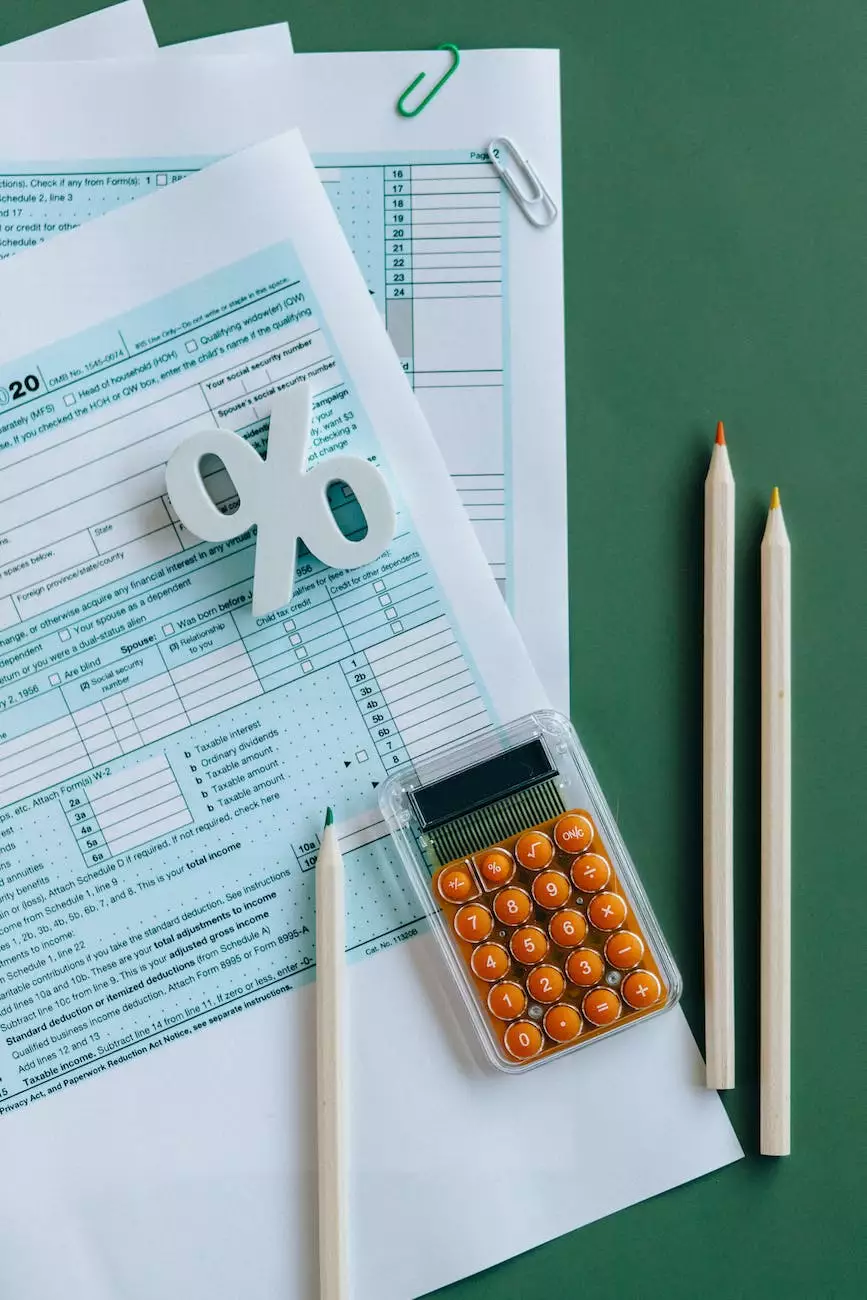

Tax Forms and Publications

Introduction

Welcome to McHugh Kathleen R, CPA - your trusted source for tax forms and publications in the realm of Finance, Accounting, and Auditing. Whether you are an individual taxpayer or a business owner, we understand the importance of having access to accurate and up-to-date tax-related documents. In this comprehensive guide, we provide a wide range of valuable tax forms and publications to help you navigate the complexities of the tax landscape.

Individual Tax Forms

Our selection of individual tax forms caters to the needs of taxpayers seeking to file their personal taxes efficiently and accurately. From the basic Form 1040 to more specialized forms such as Schedule A (Itemized Deductions) and Schedule C (Profit or Loss from Business), we have you covered. Our team of experts has curated an extensive collection of forms to ensure you have the necessary tools to complete your tax obligations successfully.

Form 1040

The Form 1040, also known as the "U.S. Individual Income Tax Return," is the primary form used by individuals to report their income and claim deductions and credits. Our website provides the latest version of this form, as well as instructions on how to complete it accurately. It is essential to have a thorough understanding of this form, as any errors or omissions could result in potential penalties or delays in processing your tax return.

Schedule A - Itemized Deductions

For taxpayers who choose to itemize their deductions rather than taking the standard deduction, Schedule A is a vital form. It allows individuals to claim deductions for various expenses, such as medical expenses, mortgage interest, state and local taxes, and charitable contributions. We provide a detailed guide on how to complete Schedule A, ensuring you maximize your allowable deductions and minimize your tax liability.

Schedule C - Profit or Loss from Business

If you are self-employed or operate a sole proprietorship, Schedule C is an indispensable form for reporting the income and expenses related to your business. It allows you to calculate your net profit or loss, which ultimately factors into your overall tax liability. Our website offers a comprehensive guide on completing Schedule C, providing insights and tips to help you navigate the complexities of self-employment taxation.

Business Tax Forms

Business owners face a distinct set of challenges when it comes to tax compliance. Our wide array of business tax forms caters to the diverse needs of various entities, including corporations, partnerships, and LLCs. Whether you are looking for forms related to payroll taxes, sales taxes, or business deductions, we have the resources you need to stay compliant with the tax regulations applicable to your specific business.

Form 1065 - U.S. Return of Partnership Income

If you operate a partnership, Form 1065 serves as the primary tax document for reporting partnership income, deductions, gains, and losses. It provides a detailed breakdown of each partner's share of the partnership's income and helps ensure accurate tax reporting at both the entity and individual levels. Our website offers the latest version of Form 1065 along with comprehensive instructions to assist you in completing it efficiently.

Form 1120 - U.S. Corporation Income Tax Return

For businesses structured as corporations, Form 1120 is the key document used to report corporate income, deductions, and tax obligations. This form requires detailed financial information and is subject to close scrutiny by tax authorities. At McHugh Kathleen R, CPA, we provide thorough guidance on completing Form 1120 accurately, helping you navigate the complexities of corporate tax reporting.

Tax Publications

In addition to tax forms, reliable and up-to-date tax publications are essential resources for staying informed about changes in tax laws, regulations, and procedures. Our website offers a comprehensive collection of tax publications from the IRS and other authoritative sources. These publications cover a wide range of topics, ensuring you have access to the knowledge you need to make informed decisions and comply with tax obligations effectively.

IRS Publication 17 - Your Federal Income Tax

IRS Publication 17 provides a comprehensive overview of individual income tax for U.S. taxpayers. This publication covers various topics, including filing status, exemptions, deductions, credits, and tax calculations. It serves as a valuable resource for individuals looking to enhance their understanding of the tax code and ensure accurate tax reporting. We provide a direct link to this publication on our website for your convenience.

IRS Publication 334 - Tax Guide for Small Business

Small business owners can greatly benefit from IRS Publication 334, which offers valuable guidance on tax-related issues specific to entrepreneurs. Topics covered include business income, expenses, self-employment taxes, and recordkeeping. Our website provides a direct link to this publication, enabling you to access this vital resource and make informed decisions regarding your small business taxes.

Conclusion

At McHugh Kathleen R, CPA, we understand the importance of easy access to accurate tax forms and publications. Our website serves as a comprehensive hub for individuals and businesses seeking the resources necessary to navigate the complexities of the tax landscape efficiently. By empowering you with the knowledge and tools to fulfill your tax obligations accurately, we aim to ensure optimal compliance while minimizing your tax liability. Trust McHugh Kathleen R, CPA for all your tax form and publication needs in the realm of Finance, Accounting, and Auditing.